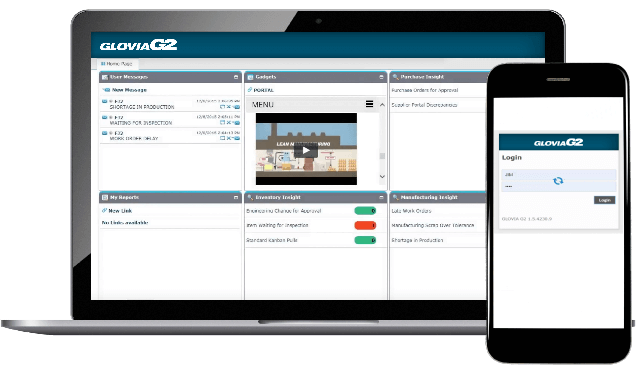

System Capabilities

The Fixed Assets ERP software module handles asset registration, classification, tagging, retirement and disposal for individual as well as composite assets. Management functions provide financial, tax and lease asset accounting capabilities in addition to repair/service scheduling. The system handles multiple depreciation methods and is fully integrated with the general ledger.

Asset Registration

The manufacturing accounting software application records all information associated with assets including asset identification codes, descriptions, values, locations, and information on dates, insurance, depreciation methods and asset life periods.

Asset Classification

The Asset Classifications feature provides a choice of user-defined codes for categorizing assets for recording and reporting purposes.

Multiple Depreciation Methods

Multiple depreciation methods and the ability to create your own depreciation method provide additional flexibility. Depreciation costs can be calculated as often as necessary.

Composite Assets

GLOVIA G2’s Fixed Assets manufacturing accounting software module enables assets to be linked together. The ability to handle composite assets provides control through flexible asset structures reflecting parent/child relationships (whereby a desktop might be defined as a monitor, CPU and printer).

Other Features

Other features in the Fixed Assets accounting management software module provide asset control through flexible asset structures, retroactive processing, long-term projections, user-definable calendars and the ability to track insurance and replacement costs.

Depreciation Methods

- Straight line

- Modified accelerated cost recovery system

- Declining balance

- Remaining life

- User-definable depreciation methods

Additional Capabilities

- Asset Tags

Provide the ability to print tags that can be physically attached to the asset - Asset Retirement

The Fixed Assets application helps schedule and report the retirement of an organization’s assets - General Ledger Postings through Financial Migration Management

Allows depreciation journals to be posted to the General Ledger as determined by the user.

Contact CrescentOne to learn more about implementing our GLOVIA G2 Expense Reporting & Processing accounting software capabilities at your manufacturing company.

Contact UsExplore More Capabilities

Select a product category below to see how CrescentOne can improve a particular aspect of your business